What is a student loan?

A student loan is a loan specifically for students to help them pay for higher education, such as university. The loan is usually split into two parts: one for tuition fees and the other for maintenance fees.

The tuition fee loan is intended to cover what it costs for your place on the course, and it gets paid directly from the student loans company to your education provider (so you don’t get to see that part hit your bank!).

The maintenance fee loan is then intended to cover any costs you might need to spend buying books and supplies, as well as living expenses if you move away from home.

Where can I get a student loan?

All student loans are managed and approved by the Student Loans Company, and you need to apply on the student finance section on the gov.uk website.

Student Loans Company: The Student Loans Company is a government owned organisation administers loans and grants to students in colleges and universities in the UK

You’re eligible for the loan if your course is in the UK and is one of the following:

- a first degree, for example BA, BSc or BEd

- a Foundation Degree

- a Certificate of Higher Education

- a Diploma of Higher Education (DipHE)

- a Higher National Certificate (HNC)

- a Higher National Diploma (HND)

- an Initial Teacher Training course

- an integrated master’s degree

How much money do you get with a student loan?

For the tuition fee loan, you can borrow the full amount of the course up to £9,250. The maintenance fee loan varies from person to person because it is dependent on household income.

Everyone eligible for student finance will be able to get a maintenance loan of some amount, regardless of their financial situation. But those coming from low-income households will be eligible for a higher maintenance loan than those coming from higher-income households.

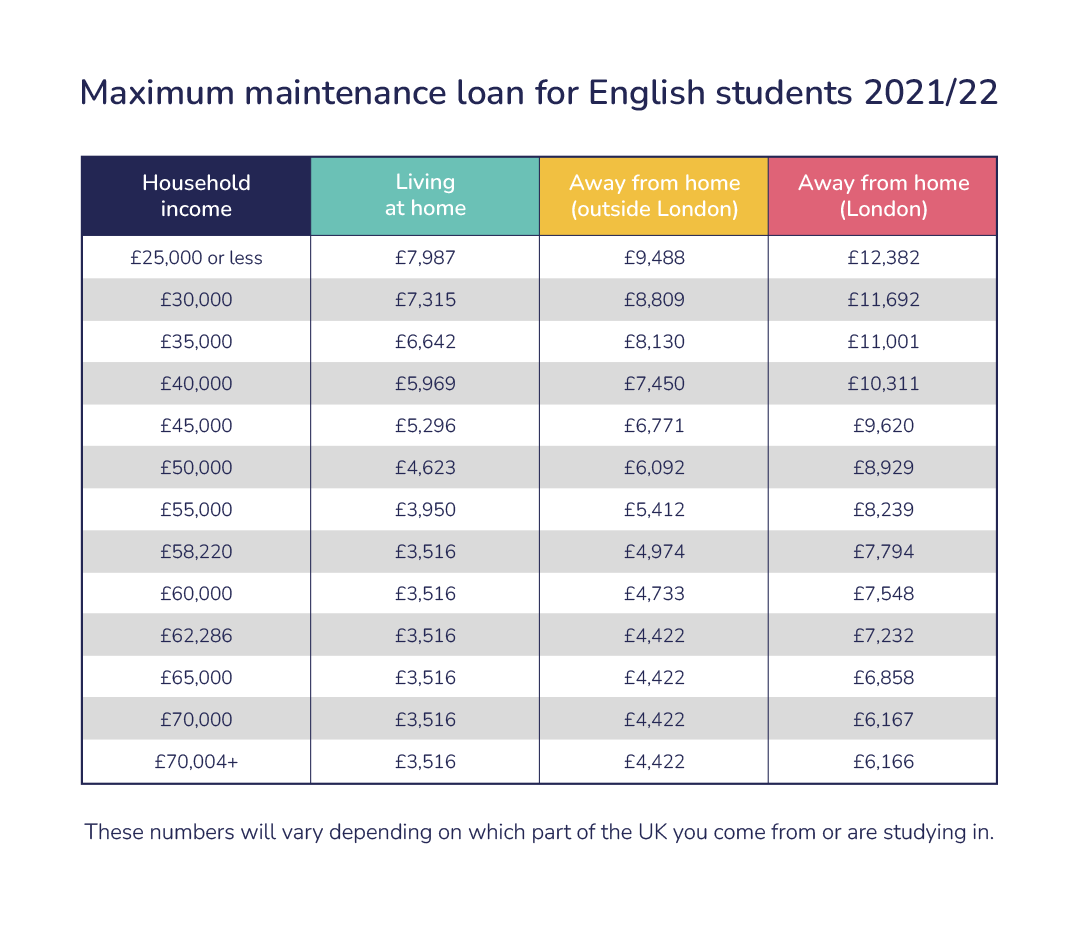

To give you an idea of the kind of amounts you could expect, here are the maximum maintenance loan amounts for different household incomes in 2021/2022. Just remember, you might not get the maximum, but it’ll give you an idea of a potential ballpark figure:

To find out how much you’d get exactly, you’ll need to make the official application and submit documentation to prove your household income.

What is a normal amount of student debt?

There isn’t a ‘normal’ amount of student debt because the size of the loan is dependent on individual student circumstances like your family’s household income and whether you decide to live away from home.

With a student loan, the total amount you borrow isn’t directly linked to how much you have to repay back overall or linked to the amount you pay back each month. The amount you repay in total and how this is paid back on a monthly basis solely depends on what money you earn after university.

Because you’ll only repay the loan if you get a job which pays you a salary over a certain threshold, the amount of debt you take on with a student loan isn’t as important as with a normal loan. If you don’t earn a lot following your university degree, you will have to repay very little, or even nothing.

How much do I have to repay on my student loan?

How much you repay on your student loan is directly linked to which student loan repayment plan you are on (which differs depending on when you started university), and how much you earn once you have graduated. You need to look at what you earn above the threshold and take 9% of that.

For example, if you are on a £30K salary and have a plan 2 student loan, your monthly income (before tax and other deductions) is £2,500, which is £226 above the threshold. Your repayment amount would be 9% of £226, meaning you’d pay back £20.24p that month.

The repayment works like an additional tax and is usually arranged directly via your employer, before your salary actually hits your bank account.

The repayments will stop either when you finish repaying the total amount of debt, or when 30 years (from the April after your graduation) have passed – it’s just whichever comes first.

That means if you never get a job earning more than the minimum repayment threshold, then you won’t need to pay a penny.

What are the different student loan repayment plans?

The different repayment plans vary depending on which year you started university and what the government policy was at that time. Here’s a list of the different thresholds for the different student repayment loan plans:

- Plan 1: If you started university before September 2012, you will be on a Plan 1 student loan and you’ll only repay when your income is over £382 a week, £1,657 a month or £19,895 a year (before tax and other deductions).

- Plan 2: If started university after September 2012, you will be on a Plan 2 student loan and you’ll only repay when your income is over £524 a week, £2,274 a month or £27,295 a year (before tax and other deductions).

- Plan 4: If you’re a Scottish or EU student and started university after September 1998, you’ll be on a Plan 4 student loan and you’ll only repay when your income is over £480 a week, £2,083 a month or £25,000 a year (before tax and other deductions).

Will I need to make student loan repayments when I’m on maternity leave?

Whether or not you pay your student loan while on maternity leave depends on your maternity package. If you have a package where your employer tops up the statutory maternity pay to a percentage of your total salary, you need to check what that amount will be and whether it’s above the student loan minimum repayment threshold (detailed above).

If it is above the minimum threshold, you will still repay 9% of whatever you are earning above the threshold. If it’s below the minimum threshold, then you don’t need to make any repayments until your earnings return to an amount above the threshold amount. You don’t need to do anything yourself to stop or restart the payments – it will all be done automatically as your earnings change each month.

If you are on statutory maternity pay only, you won’t need to make any repayments as you will be below the threshold.

.png)